SBI Online during COVID-19 Lock Downs

Online SBI - SBIs internet banking

SBI Online is the net banking platform provided by the largest lender of India - State Bank of India to all its customers(including non individuals such as companies and partnerships). The SBI online platform is divided into 2 segment i.e. Personal Banking for individual customers and Corporate Banking for non individual customers such as companies etc. The portal of SBI Online is end to end encrypted and thus provides complete safety from any possible security threats to the account while accessing it. The portal also makes use of its three stage authentication technique through the use of OTP to provide safe and secure financial services in real time.

The use of this platform has been enhanced and brought into light by the recent events originating from contagion spread of COVID-19 resulting in nation wide lock downs. The financial services though categorized as Essential Services still are affected as the customers expose themselves to risk while visiting the bustling bank premises. It is for this reason, the SBI Online platform offers an excellent alternative.

The use of this platform ensures safe, secure and hassle free financial services at the touch of a finger or click of a mouse as the case may be. The first step towards using this suave platform is the creation of a user profile by registering online. This is done by following the steps as shown below :-

- Go to New User Registration.

- Enter the Data Field in the user driven registration window(Account no, name etc.)

- Note to select the transaction rights in the user driven registration as per your requirement.

- After submitting enter the OTP obtained in your registered mobile number for authentication.

- After authentication activate your Internet Banking registration through ATM card.

- Create your username and password as per instructions provided and you are good to go.

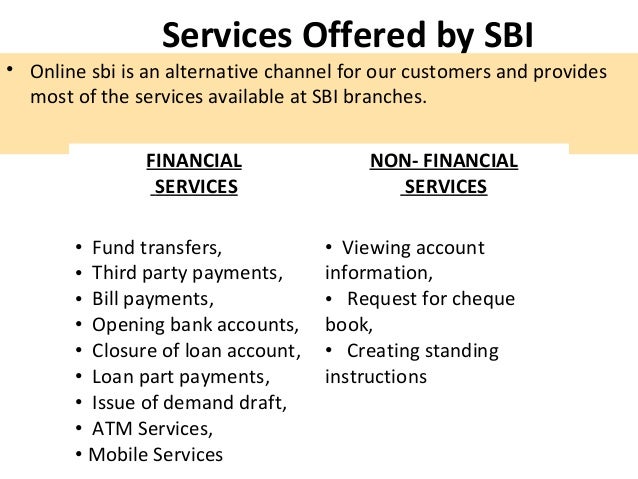

Once a user finishes of with the registration he is ushered into an era of financial marvel and has a bevy of options at his disposal. Some of them are - Fund Tranfer - To other bank accounts, to SBI accounts or to our own accounts within SBI, UPI, Quick transfer - without adding beneficiary, IMPS, NEFT, RTGS and many other value added services and requests to name a few.

Comments

Post a Comment